Chinese internet: new cyber law and rumored shutdown

It was rumored that China would shut down its internet around March 1st (see Ren Ren Caption, a popular Chinese P2P movie streaming service, asking users to back up their downloads by March 1st). The shutdown didn’t happen. Instead, the Chinese government issued draft regulations on new “governance of the online ecosystem,” which Voice of America calls “the most stringent cyber purge” (in Chinese internet history). China Law Translate has a thorough English translation of this new regulation in its blog Governing the E-cosystem.

However, if you are not up to digesting the opaque Chinese regulation terms—as they always are—a WeChat user named DaMao (big cat) claimed he possessed a list of provisions that Chinese internet users are subject to. The list is unverified, but according to the list, topics or accounts highly subject to be blocked or penalized include:

- Discussion of Wuhan’s epidemic situation

- Vaccine patent dispute between the U.S. and China

- Discussion on China-US. trade dispute

- Discussion on the Party’s internal power struggle

- Discussion on Taiwan or Hong Kong, whether “left” or “right”

- VPN users (monitored by users’ VPN usage and broadcasting frequency)

- An owner of a mainland Chinese social media account (e.g. WeChat or WeiBo) who also owns social media accounts overseas (e.g. Youtube, Twitter or Facebook)

- Online influencers who live in rural area, from rural entrepreneurs to fortunetellers, or online influencers who are returning to an urban area from the countryside

- Some enterprises’ social media accounts, particularly educational enterprises

- Celebrities, whether pro-government or not, are subject to online behavior monitoring and the new regulations

As for the rumored internet shutdown that didn’t happen, Epoch Times reported a regional internet shutdown in the Wuhan area.

🙈 Also, in response to a CONTRAST’s earlier report on China’s root server development (Can you Mirror the whole internet?), a CONTRAST member comments:

The root server system might also be able to serve as an alternative when government actually shuts down the internet.

Starlink now has a China counterpart

Chinese automaker Geely is getting into Satellite business, according to The Verge.

Geely’s low-orbit satellites will support high-speed data transmission, precise navigation, and cloud computing, Geely says and it will enable fast over-the-air updates to its vehicles, as well as “content delivery” to the company’s owners. It doesn’t appear that Geely wants to open up the its satellite constellations that SpaceX and OneWeb are building, and it doesn’t appear that these satellites will be used for standard internet connections.

Low-orbit satellites, Geely claims, can be accurate to within a centimeter. “This accuracy is not only important for cars, it will also become essential for unmanned flight. …Having your own satellite network to back up that demand could be a crucial advantage over competitors

Apparently, Musk thinks otherwise.

Musk has said in the near term…that he doesn’t see an advantage in fitting Teslas to be able to work with Starlink satellites because the hardware required would be too big on the car.

“The antenna for that high-bandwidth, low-latency [connection] is sort of about the size of medium pizza, which you could put on a car, but I think is more bandwidth than you would really need,” (Musk) said in January. That said, Musk admitted “it’s certainly something that could happen in coming years.

Geely Automobile is also known to be backed by Berkshire Hathaway’s Charlie Munger and Himalaya Capital’s Li Lu.

Worldwide Stimulus…

China Stimulus: 25 Trillion

China just announced its largest fiscal stimulus plan to date: It will spend 25 trillion RMB (around $3.5 trillion USD) on infrastructure across seven provinces, according to Chinese financial news portal LaoHuCaiJing.

By 2030, 71% of China will be urbanized. Sixty percent of the Chinese population will live in seven urban clusters including the Yangtze River Delta cluster, the Guangdong-Hong Kong-Macao cluster (aka China’s “Great Bay Area”) and the Beijing-Tianjin-Hebei cluster.

This means that sectors including 5G, artificial intelligence, industrial internet, smart cities, education and medical care will be vigorously developed to stabilize growth.

RFA calls this fiscal stimulus a white elephant plan.

Some provinces, such as YunNan, will receive a stimulus that’s twice the size of its GDP. This will lead to a bigger economic crisis.

Hedge fund manager Kyle Bass (who is also known for his bearish approach to Chinese currency) commented:

It’s hard to run a “massive stimulus” program in USD when you are out of them! Stimulate in RMB when you run dual deficits and get a lesson in financial history.

Michael Pettis, a finance professor at Peking University, responded:

That’s true, Kyle, but I think they still have the capacity for RMB stimulus, although that will only worsen their demand imbalances and leave them saddled with more debt, both of which will further reduce future (real) growth rates, which I think are currently at 3% or lower.

Hong Kong Stimulus: $10,000 helicopter money

SCMP reports that Hong Kong is set to unveil a HK120 billion relief deal that includes “helicopter money”—giving every Hong Kong permanent resident over the age of 18 a cash handout of HK$10,000 (around $1,300 USD)to easy the burdens on individuals and companies.

However, Alicia Garcia-Herrero, chief economist for Asia Pacific at NATIXIS, believes that throwing untargeted cash will not solve a well-defined problem. She wrote on LinkedIn:

The problem is the stimulus is untargeted and regressive in nature as the bulk of money spent is a one-off cash disbursement per adult, independently on income or damage from the coronavirus. The same amount targeted to SMEs in the most hit sectors could have a bigger impact on household income as it might help protecting their jobs or ease their burden directly.

U.S. Stimulus: Rate Cut

The U.S. Federal Reserve cut interest rates outside of its normal cycle of meetings for the first time since the financial crisis of 2008, Bloomberg reports.

President Trump balked at this plan and suggested that the Fed should have waited out the coronavirus crisis.

“we don’t need any bailout here.”

Twitter user Deep Throat IPO calls the rate cut a big mistake:

We should immediately be funding state unemployment funds, health insurance deductibles/co-pays, tax holidays/reductions for lower-income households….”free” Covid19 testing and treatment, cash for clunkers, and any other helicopter money we can think of, etc…. rather than throw trillions in the repo market and balance sheet expansion to prop up asset prices, we put some of it in the “real” economy.

Index world welcomes China but media raise eyebrows

Starting April 1st, hundreds of Chinese renminbi-denominated government and policy bank securities will be added on the Bloomberg Barclays Global Aggregate Index, a flagship measure of global investment-grade debt, with a 20-month phase-in period, China Plus reports.

This means investors who follow the index can invest in RMB bonds, which in turn will drive more capital inflow into the Chinese bond market.

China’s bond market is internationally competitive in terms of its scale and yields. By the end of February, China’s domestic bond market stood at around 13 trillion US dollars, next only to the United States and Japan.

However, a China-friendly index has already raised questions due to Chinese companies’ lack of transparency and China’s over-leveraged economy. Fox News’s Maria Bartiromo asked SEC Chairman Jay Clayton for his take on index such as MSCI in an interview (video timestamp 5:48)

Maria Bartiromo:

I don’t think (people) understand that when you’re investing in the MSCI index, this is an index that includes lots of global companies, but increasingly, more Chinese companies.

Jay Clayton:

How do you decide what goes into the index? Should index construction be based just on maker cap, on geography or on being sanctioned or not? Those are good questions.

Maria Bartiromo:

So are you working on anything at the SEC to better illuminate what people are investing in so that we clearly understand, “ you are investing in Chinese companies, and these companies are making these products, and by the way, you are not going to get the true transparency of the accounting?”

Jay Clayton:

It is complicated … but being with you (on this interview) talking about it in this way is one of many things we are doing to try and help investors understand where their dollars go.

Future of Dual-Use Technology

According to Kyodo News, a group of 42 countries, including Britain, Russia, India, South Korea, Japan and the United States, “have agreed to include military-grade cyber software and manufacturing technology of weapon-capable semiconductor parts for export control in an effort to counter cyberattacks and other international threats.” This group does not include China.

Lindsay P. Gorman, an emerging tech fellow at The Alliance for Securing Democracy and a quantum physicist and AI coder, commented on this announcement via tweet.

I’ll be curious to see the details of this agreement, but there’s no doubt that export controls on dual-use technologies need to account for the changing nature of dual-use technologies themselves.

She quoted the paper she co-authored with Matt Schrader

Dual-use technology is tech that can be put to both civilian and military uses and as such is subject to higher control. Nuclear and GPS are classic examples, but new technologies such as facial recognition, augmented reality and virtual reality, 5G, and quantum computing beginning to raise concerns about they dual applicability.

And multilateralism is a sine qua non in stemming the spread of surveillance technologies to authoritarian regimes. Unilateral approaches here are not only completely ineffective, but also further divide democratic governments economically.

However, according to the above-mentioned agreement, not-so-new technologies such as silicon wafers will be also subject to an application with the government if countries like Japan wants to export it.

A highly efficient wafer is an integral part of manufacturing a cutting-edge chip that requires extremely thin, nanolevel light beams when designing it. (Kyodo News)

World Gatherings Gone Viral ( Part II)

(Part I on Canton Fair, WMC, Tokyo Olympic)

(Update: as of the date the post is published, City of Austin has decided to cancel this year’s SXSW.)

Famous podcast host Tim Ferriss is calling SXSW to postpone this year’s meeting due to COVID19. In a tweet thread, he wrote

After much thought, I’ve cancelled my attendance at SXSW. I love SXSW, but I don’t believe the novel coronavirus can be contained, and I view an international event of 100K+ people as a huge risk to attendees and the entire city, given limited ICU beds, etc. I implore (Austin) Mayor Adler and his team to carefully evaluate the downsides. SXSW brings huge economic benefit to Austin, but possibly making Austin a hotspot for SARS-CoV-2/COVID-19, and the emergency actions + funding that would require, could make a huge event seem shortsighted.

Austin Public Health officials on Wednesday said that canceling next week’s South by Southwest festival won’t make the city safer from the virus, according to the-Austin American-Statesman:

“Today the threat of community spread in Austin remains low, however, we are prepared for it to happen here,” said Dr. Mark Escott, interim medical director and health authority for Austin Public Health. He said it is not a matter of if but when COVID-19, the disease caused by the new coronavirus, shows up in Austin.

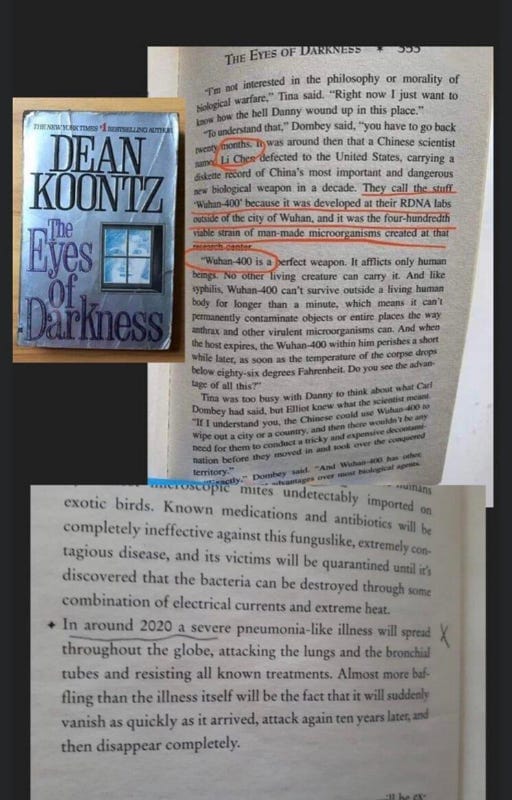

Books successfully predicted China’s Coronavirus outbreak

Believe it or not, two books have predicted the COVID-19 outbreak. One is called Coronavirus (yes, you read that right) by Chinese author Bi Shumin, released in 2012. Another is called The Eyes of Darkness, a thriller by American writer Dean Koontz, released in 1981.

In Coronavirus, a fictional city in China starts to see a novel coronavirus spreading from person to person. The city is quarantined, and people’s lives go in chaos.

In The Eyes of Darkness , a mother discovers her son has been infected by a man-made microorganism called “Wuhan-400.” It turnes out an outbreak has been planned for 2020. Screenshots of some pages of the book have gone viral online.